Workplace Wellness Programs Statistics Software

The RAND Employer Survey, a national survey of employers with at least 50 employees in the public and private sectors, including federal and state agencies, to assess program prevalence, type of wellness programs, information on incentives, and perceived program impacts. • statistical analyses of medical claims and. One of the best ways to evaluate the productivity and effectiveness of a wellness program is assessing employee wellness programs statistics.

Workplace wellness is under scrutiny. What’s the truth here?

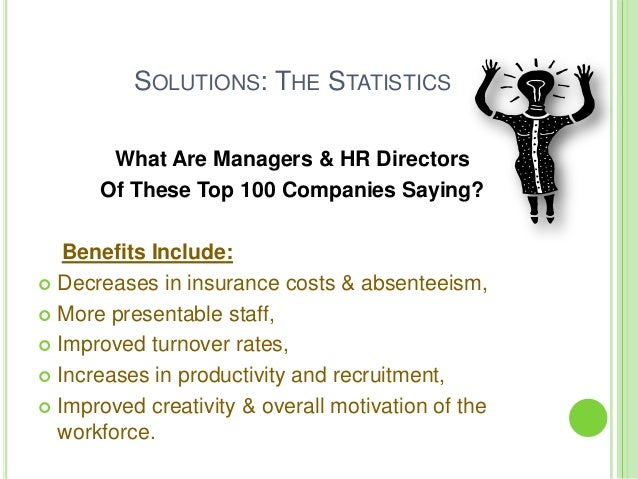

Can wellness programs help employers reduce out-of-control health care costs? The answer, most emphatically, is yes. Esri Enterprise License Agreement Elaborate there. But we must first go beyond unduly narrow interpretations of ROI (i.e., “claims ROI”), to understand how properly designed wellness programs can help employers lower health care costs while providing other types of cost savings and competitive advantages.

The current ROI debate has focused on whether one type of wellness program, lifestyle management (diet, exercise, and lifestyle changes), can reduce health care claims and lead to lower costs. Here, I agree with critics that lifestyle-focused programs do not significantly lower claims costs. Hot Wheels World Race Ps2 Iso Creator. But, the real question is not whether wellness programs deliver returns. Rather, it’s what type of wellness program can reduce claims and thereby lower insurance premiums.

Bni Purpose And Overview Pdf Free more. The answer is not lifestyle programs; it’s programs that prevent at-risk employees from becoming ill and help chronically ill employees stabilize their conditions. A recent Rand study,?, examined 10 years of data from a Fortune 100 employer’s wellness program. When compared against the lifestyle-management component, disease management delivered 86% of the hard health care cost savings, generating $136 in savings per member, per month and a 30% reduction in hospital admissions. At-risk employees suffer from factors like overweight, blood pressure, diabetes, and depression, which can lead to costly (and avoidable) health claims.

At-risk people should be identified through personal health assessments and biometric testing, and encouraged — not coerced — to participate in personalized care-management programs to minimize their chances of becoming chronically ill. While keeping at-risk employees healthy is critical, the shorter-term workplace-wellness ROI lies with the chronically ill, who suffer from costly conditions like advanced diabetes, heart conditions, and cancer. In a typical population, they consume at least 50% of a company’s claims expense, and focusing on them can make or break your claims ROI.

Enrolling the chronically ill in disease-management programs that ensure they get appropriate care has the most potential to reduce insurance premiums. For example, a program that preempts 25 unnecessary emergency department visits can easily save $50,000, while preventing four inpatient stays can save at least $100,000. Savings like these are not unrealistic for a 2,000-employee company.